A “third mandate” from the US Federal Reserve could change long-term monetary policy if actioned, which could be bad news for the dollar but good news for crypto.

The Fed has long been considered to have a dual mandate — price stability and maximum employment — but President Donald Trump’s pick for Fed governor, Stephen Miran, cited a “third mandate” earlier this month, sparking speculation on the future of central bank monetary policy.

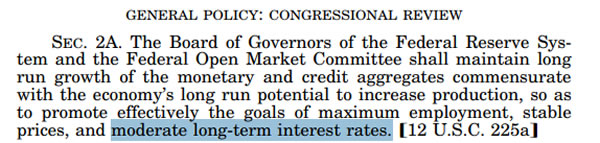

The third mandate is a statutory requirement buried in the Fed’s founding documents, which states that the central bank actually requires three objectives: maximum employment, price stability and moderate long-term interest rates.

The Trump administration appears ready to use this forgotten statutory requirement as justification for more aggressive intervention in bond markets, potentially through yield curve control or expanded quantitative easing and money printing, Bloomberg reported on Tuesday.

Lowering long-term interest rates

This third goal has been largely ignored for decades, with most considering it a natural byproduct of achieving the first two, but Trump officials are now citing it as legal cover for potential yield curve control policies, where the Fed buys government bonds to target a desired interest rate.

Trump has long advocated for lower rates, calling Fed governor Jerome Powell “too slow” or “too late” in reducing them.

The administration wants to actively suppress long-term interest rates, and potential tools include increased Treasury bill issuance, bond buybacks, quantitative easing or direct yield curve control.

Lower long-term rates would reduce government borrowing costs as national debt hits a record $37.5 trillion. The administration also wants to stimulate housing markets by bringing down mortgage rates.

Positive impact on crypto

Christian Pusateri, founder of encryption protocol Mind Network, said on Wednesday that the third mandate is “financial repression by another name,” adding that it “looks a lot like” yield curve control.

“The price of money is coming under tighter control because the age-old balance between capital and labor, between debt and GDP, has become unstable,” he said.

“Bitcoin stands to absorb massive capital as the preferred hedge against the global financial system.”

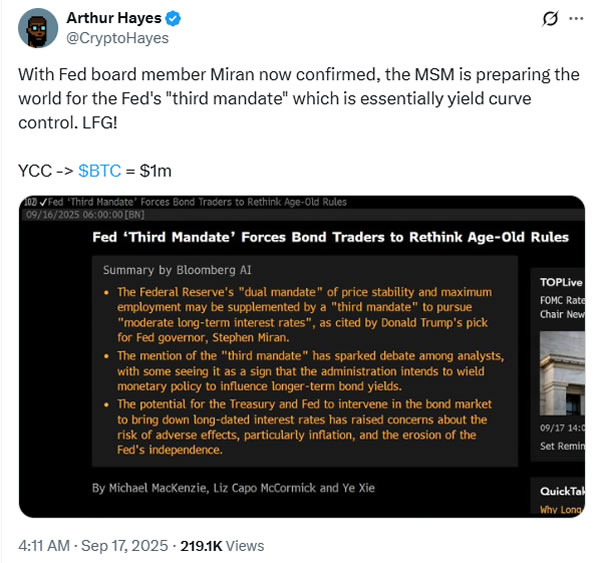

Outspoken BitMEX founder Arthur Hayes also said it was bullish for crypto, suggesting that yield curve control could send Bitcoin to $1 million.

All Comments