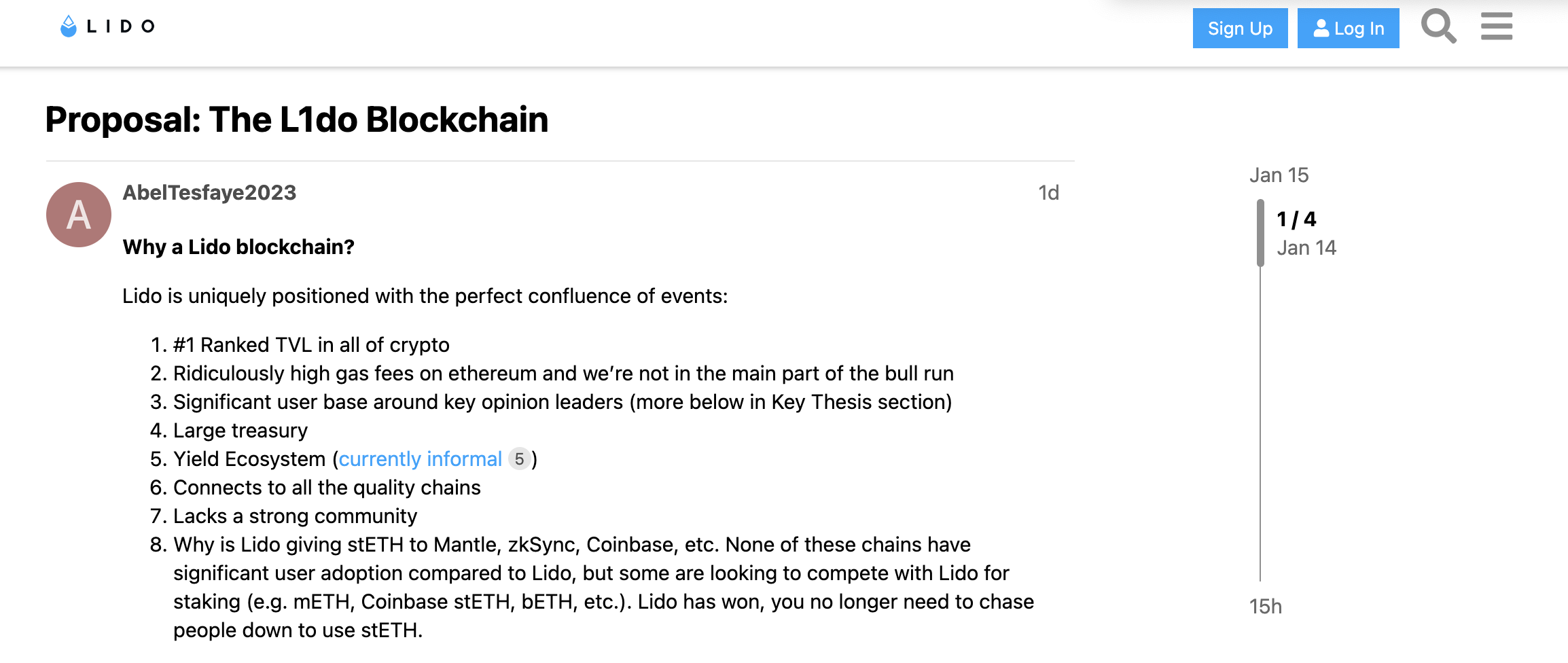

Proposal: The L1do Blockchain

Quick google search lido has over 100,000 users. Notably, these are sticky POWER Users. Why send those users to do defi on other chains? These are the key opinion leaders in all of crypto. There is no other application that has this many sticky Power Users. Why wouldn’t you want to have a perfect reflexivity, zero leakage to incentivize them to keep their stETH in Lido’s execution environment. Notably, Coinbase and OKX have launched their own L2’s and Binance has BNB chain. The users are already there, the funds are already there and thereby very little friction to onboard those users to Web3 from their exchange. Same applies to Lido chain, but it is OG web3 native.