In late 2018, the founder and CEO of QuadrigaCX, Canada’s largest digital currency exchange at the time, died unexpectedly while traveling in India. He was the only person with access to the exchange’s cold storage wallets, which contained the vast majority of the company’s cryptocurrency holdings. As a result, QuadrigaCX was unable to access these funds and was unable to fulfill customer withdrawal requests. In 2019, QuadrigaCX went to bankruptcy, with 180 million euros simply vanished into thin air without a trace. This first catastrophic event sparked fears of a recession in the sector. But very soon, the Covid-19 pandemic made its strike, lockdowns were set in place, everybody went to telework, the S&P500 fell dramatically but recovered promptly boosting the shares of tech-based companies, NFTs burst, and bitcoin reached all-time highs. All these events overshadowed the bankruptcy of QuadrigaCX and totally quelled the doubts of analysts.

Since mid-2022, luck seems to have changed dramatically, and in a direction much more compatible with what you’d expect after such bankruptcy. Actually much worse than that, especially as more unfortunate events, some scams, certainly many attacks and opportunistic behavior, unleashed a cryptowinter.

The founders of Binance, FTX, and Coinbase have seen their personal fortunes deflate since March 2022 with estimated losses totaling hundreds of billion of dollars (see for example this and this). FTX’s CEO went from preaching about the virtues of FTX and the need for friendly regulation in the halls of the US Congress, to being confined at his family’s home. And the stain of the former FTX leader has not yet stopped. His ex-partners signed collaboration agreements with the prosecutions. Regulators are also taking a hit: the general counsel of the US Securities and Exchange Commission announced his departure from the entity after it was revealed that he frequently dined with FTX’s CEO.

The drama of FTX then forced other executives in the sector to reinvent themselves. Binance’s CEO has made huge efforts to calm its user base, whose withdrawals reached over a billion dollars in just one day. Coinbase’s leader took a more practical approach, and since May 2022 he has become a preacher in favor of regulating the sector, allegedly to avoid FTX-like events happening again. But history does not forgive: in May 2021, he had assured that regulation was a threat to the free economy that cryptocurrencies intend to enable.

Other players in the sector have taken a more aggressive position; for example, Ripple bets on criticizing the authorities for their actions against FTX’s CEO while showing a benevolent attitude towards other actors in the financial system, such as big banks, who also play their malevolent cards.

The collapse of FTX was just the latest crisis in the sector, as of January 2023. But probably the collapse of stablecoins Terra USD and Luna in May 2022 was the true turning point of the crisis. The disappearance of more than 45 billion dollars in investments in these coins, caused the flight of its founder from the authorities of South Korea, who are still looking for him for fraud -actively researched by investigating the blockchains.

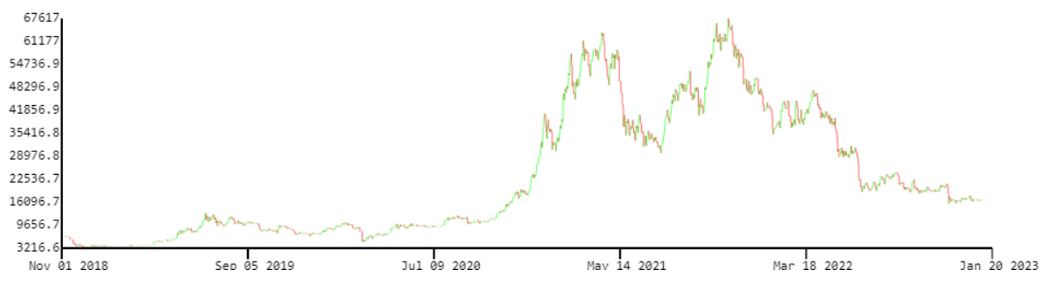

By mid-2021, bitcoin reached over 65,000 USD, and then began a decline, first slow and bumpy, then faster. By January 2022, after announcements by the Federal Reserve about upcoming regulations, the crypto market thought that bitcoin would not fall below 39,000 USD. Today, January 2023, it is quoted at less than half, having fallen almost 70% in just 1 year. It’s terrible for individuals, and also for countries like el Salvador who bought billions during 2021 when bitcoin was only starting to decline.

But hope is not entirely lost for any of those involved, as the case of QuadrigaCX shows: 1.5 million euros in the form of bitcoins associated with the company were transferred a few days before Christmas 2022. Four years after its bankruptcy, the defrauding of its almost 200,000 clients and the suspicious death of its founder, the new movement proves that the last word is never said in this sector.

Likewise, there’s active research on Terra’s USD / Luna. History and blockchains don’t forgive, and certainly they don’t lie, so many are investigating them deeply -finding several irregularities.

Cryptocurrencies have lots of cool applications.

And I had much faith in one of them: cryptocurrencies as a means to break free from tyrannous regulations:

These digital assets are decentralized, meaning that they are not controlled by any single entity such as a government or financial institution. This decentralization allows for greater freedom and autonomy for users, as they are able to make financial transactions and transfer value without the need for third-party intermediaries.

Besides, since cryptocurrencies are not subject to the same regulations and controls as traditional fiat currencies, individuals and businesses can use them to make financial transactions without having to worry about government interference or oversight. For example, in countries where financial transactions are heavily regulated or restricted, cryptocurrencies can provide a way for people to bypass these restrictions and conduct transactions freely. I’m not promoting any bad uses, just pragmatism: easy sharing money or sending financial help to family members, easy currency exchange when you change country (or avoiding that at all), and the like.

It’s important to note that cryptocurrencies are not completely free from regulation, as bitcoin was when it was born. Many countries have begun to implement rules and regulations surrounding the use and trade of cryptocurrencies, and it is likely that this trend will continue in the future. However, the decentralized nature of cryptocurrencies makes it difficult for governments to completely control and regulate them.

My view is that there is some optimal balance between freedom and regulation, that we haven’t reached yet. With so many scams, frauds, and technical vulnerabilities, it becomes obvious that we still do need more regulations. Thus one of the core values, regarding economic freedom, will probably very much dilute. That’s why I think that every single person who helped unleashed the crypto winter has screwed up the liberating potential of cryptocurrencies. We will now hopefully will learn to focus on all other applications, to develop true value.

All Comments