After the 10·11 market crash and an extended period of caution, the crypto market is witnessing a structural recovery. From ETF inflows and renewed institutional interest to rising rate-cut expectations and easing regulations, a new liquidity cycle is quietly unfolding. This time, the spotlight is not only on Bitcoin but on the awakening of the entire on-chain financial system.

I. Market Recovery: ETF Inflows and Institutional Re-Entry

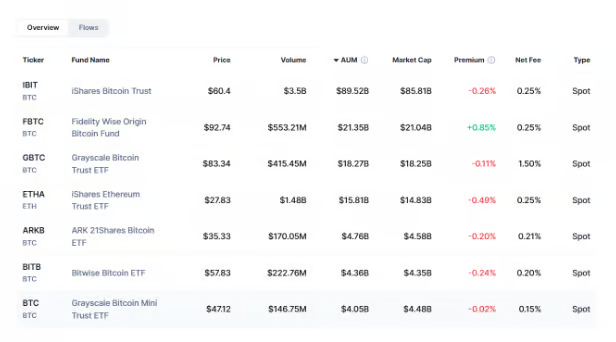

Data shows that Bitcoin spot ETFs recorded a net inflow of $4.21 billion in October, fully reversing the outflow trend of September. Assets under management rose to $178.2 billion, accounting for 6.8% of Bitcoin’s total market cap. Between October 20 and 27 alone, new inflows reached $446 million, with BlackRock’s IBIT contributing $324 million and surpassing 800,000 BTC in holdings.

More importantly, this rally bears a strong institutional signature. Morgan Stanley has opened BTC and ETH allocations to all wealth-management clients, while J.P. Morgan now allows Bitcoin as loan collateral. Institutional crypto exposure has climbed to 5% of portfolios, and 85% of institutions plan to increase allocations within a year.

Meanwhile, the first U.S. altcoin ETFs—covering Solana, Litecoin, and Hedera—have launched. Over 155 similar funds are awaiting approval, with a projected combined scale exceeding early BTC and ETH ETF inflows. This signals that institutional risk appetite is expanding from Bitcoin toward the broader DeFi ecosystem.

ETFs are more than financial instruments—they are capital entry channels. As these channels extend from BTC and ETH to SOL, XRP, and AVAX, the market’s valuation logic will be reshaped. Capital, entering through compliant means, is redefining crypto’s funding gateways.

II. Macro Environment: Rate Cuts and the Return of Liquidity

On the macro front, the U.S. Federal Reserve’s latest decision introduced a 25-basis-point rate cut in October. Lower rates push capital to seek higher returns—and with traditional markets stagnating, crypto again becomes a safe harbor for yield.

Policy dynamics are also shifting toward openness and collaboration. The White House nominated Michael Selig, a crypto-friendly candidate, as CFTC Chairman, while the SEC adjusted ETP mechanisms to allow in-place ETF redemptions, significantly reducing liquidity barriers. These moves mark a regulatory pivot from defense to construction, opening new space for compliant industry expansion.

On-chain data confirms the confidence rebound: DeFi total value locked (TVL) grew 3.5% in October—a signal of not only capital returning, but trust returning.

III. Nivex’s Strategic Layout: Intelligence, On-Chain Integration, and Systemization

As the industry enters a new stage of institutionalization, intelligence, and compliance, Nivex stands out as a leading representative. Its strategic roadmap revolves around three core pillars: AI Strategy System, Web3 Wallet, and Multi-Chain Collaborative Ecosystem.

1. AI Strategy System: Smarter and More Resilient Trading

In an era of high volatility and rapid liquidity shifts, traditional manual strategies often fail to handle extreme markets. Nivex’s AI strategy engine—combining quantitative models, on-chain data, and sentiment analytics—can identify market risks in real time and automatically execute take-profit or stop-loss actions.

During the 10·11 crash, the system’s smart-risk module detected liquidity fractures early and activated defensive measures, helping most users avoid liquidation zones—some even secured profits against the trend.

This is more than a risk-control tool—it’s an intelligent asset-allocation engine providing users with 24/7, fully automated, institutional-grade strategy services.

2. Web3 Wallet: A Unified Gateway Connecting Users and On-Chain Finance

The newly launched Nivex Web3 Wallet has become a key strategic pillar of the ecosystem. It offers non-custodial security, multi-chain management, cross-chain interoperability, and DID identity integration—enabling users to manage assets, make cross-chain payments, and invest in DeFi through a single portal.

Crucially, it integrates seamlessly with the Nivex exchange account system. Users can directly access exchange-grade liquidity and AI strategy features from their wallet, achieving a truly unified on-chain trading experience. The wallet serves as the traffic entry point, while the exchange acts as the profit exit—together forming a growth flywheel linking user assets to strategy execution.

3. Multi-Chain Collaborative Ecosystem: Open Rather Than Closed

In the multi-chain era, Nivex chooses collaboration over isolation. It has forged a deep partnership with next-generation public chain PopChain, creating a three-layer architecture—wallet, public chain, and exchange—where assets, identities, and strategies interconnect. Going forward, Nivex will further enable cross-chain liquidity, offering users a truly global “multi-asset, single-account” experience.

Conclusion: Nivex, the Bridge to Intelligent Finance

The market is undergoing a structural shift—from speculation to allocation, from manual to intelligent, from isolation to integration. In this transformative cycle, Nivex is emerging as the bridge linking traditional finance and crypto. Its AI Strategy System makes trading smarter, its Web3 Wallet frees assets, and its multi-chain ecosystem drives openness.

As global capital returns, institutions re-enter, and regulation redefines the rules, Nivex stands at the threshold of the next cycle. It will continue to strengthen its core competitiveness in smart trading and risk management, while building an integrated infrastructure of AI + Wallet + Public Chain—the foundation for a new generation of intelligent financial systems.

In this liquidity-driven new world, Nivex is not merely a participant—it is a catalyst. It signals a new era where crypto finance moves from speculation to maturity, and the intelligent future has already arrived.

All Comments