The first time someone hears crypto they think of magic money. Their immediate thought is about investing money in it. Later they get to know about the benefits of decentralization. Blockchain based trading and charting is something that is not well explored right now.

Lambda Markets is a project brings to you a blockchain based trading platform with advanced trading and charting tools.

What is Lambda?

It is a trading information and charting tool that envisions becoming “the single most important web-application for cryptocurrency traders and investors.” Lambda Markets is built on Solana blockchain. It aggregates data from Centralized Exchanges and DeFi sources to derive insights.

The platform allows for real-time trade signals, advanced order types, and one-click execution through:

- Advanced charting library

- Algorithmic trading

- Macro-economic dashboard

- Trade Engine for trade execution and management

- Live trade signals with strike alerts

All these features can be availed of by using a Solana blockchain wallet for authentication. Lambda even goes on to say that you will not need to subscribe to any charting tool like TradingView. The platform has everything you need.

Features of Lambda

- Charting Library — Lambda’s charting library claims to provide all the tools that are provided by other projects. You can draw and narrate on the chart, make a watchlist of assets, and use algorithmic screener to filter the market noise.

The library has:

- Unlimited candle timeframes

- Order-flow overlays

- CEX trade execution

- Strike algorithm integration

Let’s study them in detail.

- Unlimited candle timeframes

On Lambda 2.0, all users, free and paid, can access it. The time ranges from less than 5 minutes to 12 months which provides a lot more insights than the plain old standard timeframes like the 1H, 4H, D1, and W1.

- Draw — Users can draw shapes, lines, or any technical indicators they wish.

- Order-to-flow Tooling

With the order-to-flow overlays, you can check the Cumulative Volume Delta (CVD), Open Interest (OI), funding rate data, liquidation data, and many more such metrics. It helps traders understand how the market could shape up. These metrics can be used in combination with the Strike algorithm to form trade strategies. This tool is available to ‘Basic’ and ‘Pro’ tier users but not the free ones.

- Strike Algorithm

It is a directional trading algorithm that indicates optimal entry and exit signals for cryptocurrency and traditional market assets. These signals are printed on the price chart in real time.

It works on all timeframes using backtested technical analysis data, derivatives market data, and order flow to generate high-probability trade opportunities in real time.

Strike is constantly refined to earn more and lose less.

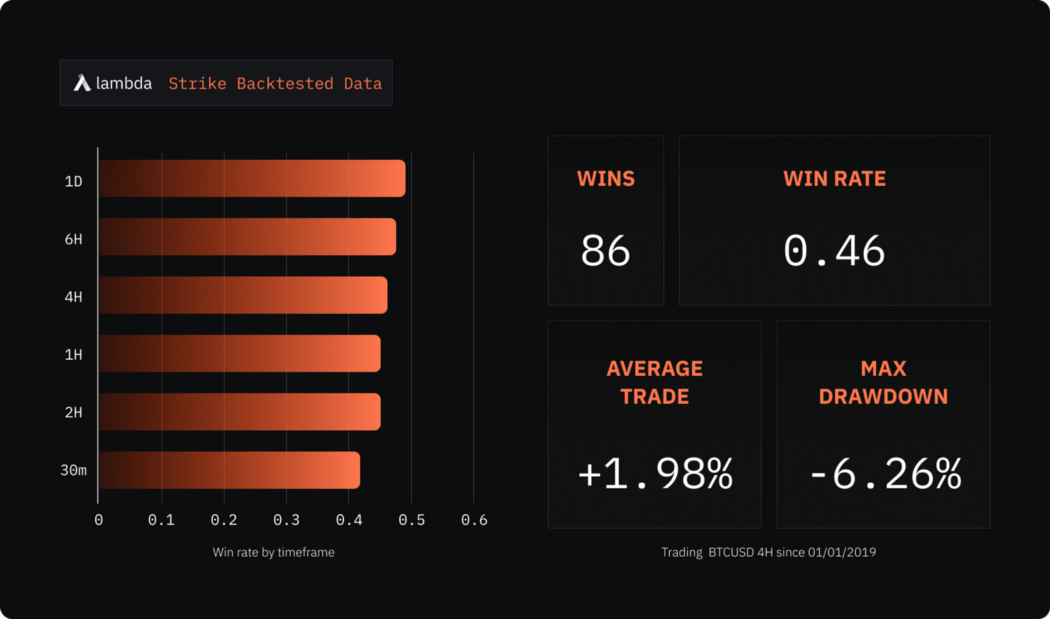

- Backtested Results

Here are the backtested results of Strike for BTC/USD since January 2019. It uses the automated strategy used directional signals from Strike on the 4-hour timeframe to enter and exit positions.

Here’s another chart of buying on Hard Bull signals and selling on ‘Hard Bear’ signals. The returns seem consistent and attractive.

- Macro Dashboard

When you are actively trading or investing, it becomes difficult to keep track of the different events and metrics taking place in the market and the economy

That’s why Lambda has its Macro Dashboard.

Lambda 2.0 Macro Dashboard will have:

- Economic Calendar: It is a customizable calendar showing upcoming macroeconomic events. You can set it to your preferred timezone and can also filter out events that are not relevant to you.

- Monetary Policy Radar: It provides the policy, interest rates, and stance of central banks on crypto throughout the world.

- Market Sentiment and Market Risk Profile (MRP) data: It helps identify the liquidity conditions and also shows the trader sentiment and risk appetite data. MRP is calculated from global central bank key interest rates, money supply balance sheet fluctuations, consumer inflation and employment data, energy prices, historical & realized volatility, USD strength, and movements in the US bond market.

- Real-time Newsfeed: It collects the news from different sources and aggregates it on one unified dashboard.

These dashboards will give a 360-degree view of the market to users.

- Trade Engine

This is where all the action happens. Here all the trades are executed and managed. You can integrate the Strike algorithm with your account on any centralized exchange. Furthermore, a Telegram account is needed to automate everything.

With this engine, you can execute advanced orders like Scale (Ladder) Time-weighted-average-price (TWAP) & Swarm orders, trade on Telegram, aggregate non-directional opportunities, and get Institutional grade API key storage. The trade engine also allows users to customize strike alert feeds to filter market noise.

LMDA Token

LMDA is the utility token of the platform based on Solana blockchain. It provides you access to the Lambda Markets platform and the Lambda ecosystem.

Uses of LMDA:

- Access to Lambda 2.0: With LMDA token you can subscribe to the platform and also enjoy different features

- Rebates: By locking LMDA you can avail of special tiered discounts. Also, by referring friends and family you can get more rebates.

- Accrue value: As the user base grows, your LMDA will accrue more value.

Tokenomics

The total supply of LMDA is 100 million of which 90% is floated to early investors and the remaining is with the Lambda Vault to provide liquidity in the market.

- Public Sale (Lambda Users): 90,000,000 tokens

- Lambda Vault: 10,000,000 tokens

The 10% LMDA in the Lambda Vault will never be sold on the market.

There is no allocation for team, private funds, venture capitalists (VC), or community allocation. Lambda believes in distributing the token to the public. Therefore, the chances of manipulation by institutional investors are 0.

- Deflationary Token

Through a token burning mechanism, LMDA’s supply will become scarce putting deflationary pressure on the token. Lambda believes that releasing the whole supply of LMDA at launch enables them to have a deflationary token market.

Users need to lock their LMDA tokens in the Lambda Vault’s vault smart contract to activate new features and subscriptions. 10% of these locked tokens are burned and the remaining 90% of the tokens in the vault are meant for passive liquidity provision.

The price to unlock platform features and subscriptions is denominated in USD but is paid in LMDA. So, if LMDA’s price is depreciating, more LMDA tokens are needed to be paid in order to access the features and subscriptions. Therefore, more tokens are burnt which makes the token more deflationary.

During subscription renewals again more LMDA would be used and locked in the vault. So, the circulating supply is reduced by regular burns. The project claims that with a 90% circulating supply at the launch, it is able to have a consistent deflation.

LMDA Staking

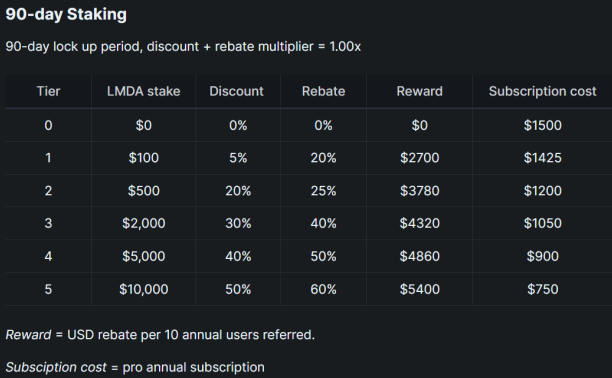

The periods for staking lock-ins are 30-day, 60-day or 90-day epochs. You cannot unstake the tokens before the lock-in period ends. It is scheduled to launch in February 2023.

On top of staking rewards, there are tiered referral rebates and discounts depending on the number of LMDA tokens staked and the time they are locked for. Along with this, future ‘staked-only’ platform features will be available in-app.

The rebates will be paid in LMDA tokens for the amount of USDC value owed.

Conclusion

Lambda aims to become the Swiss army knife of crypto trading providing all the necessary tools for advanced trading. It needs to gain a lot of ground in the space.

But Lambda is a very ambitious project for crypto trading and it already has a working product. They just have to improve the platform and excited to see what the time is going to bring them.

All Comments