Throughout the year, centralized crypto exchanges and service providers have lost a lot of trusts. Due to the events surrounding Celsius, FTX, and Binance more and more people realize the importance to hold cryptos by themselves. In this article, I will teach you what to look for when choosing a self-custody crypto wallet.

What is a Self-Custodial Wallet?

A self-custodial wallet is a wallet that gives the user total control of their private and public keys. As a result, the user has full control of his own crypto wallet and assets. If users lose the private key, they can no longer access their crypto assets in the wallet.

Examples of self-custodial wallet

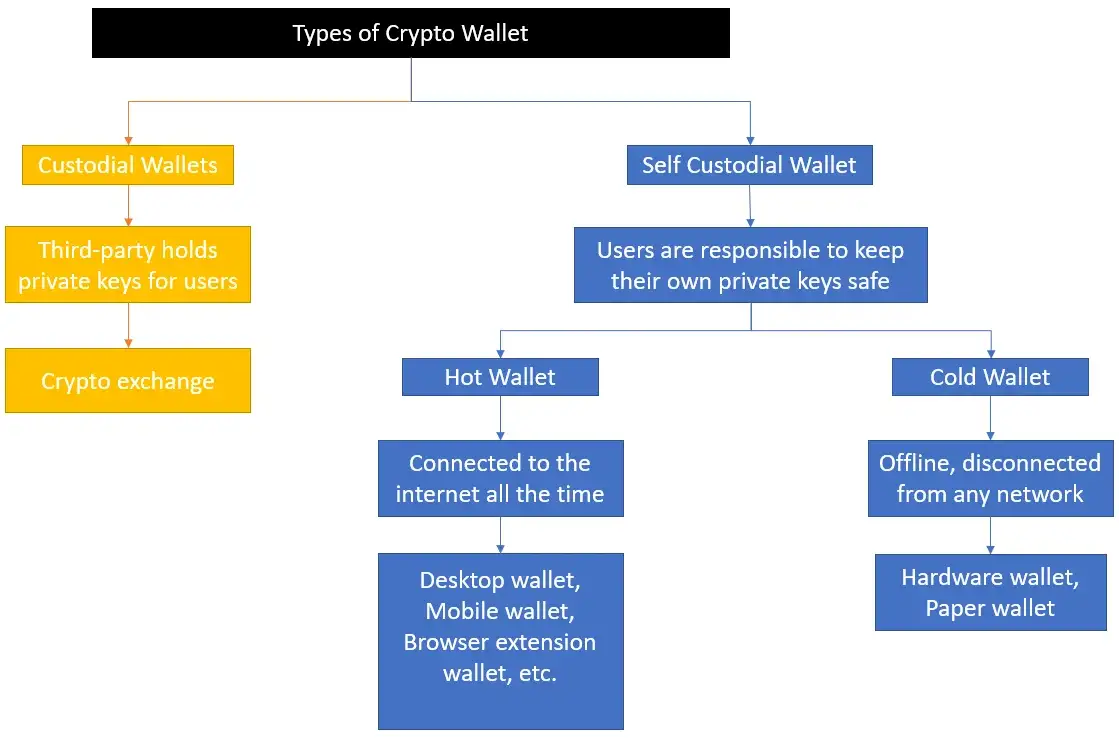

There are two kinds of self-custodial wallets:

- Hot Wallets: wallets that are connected to the internet all the time.

- Cold Wallets: wallets that are not connected to any network.

For better visualization, I have made this chart.

Custodial vs. Self-Custodial Wallet

Here is a comparison of the main differences between a custodial and a self-custodial wallet:

Access to crypto assets

- Custodial: Your private keys are under the control of the service provider. Which basically means that they have control over your funds.

- Self-custodial: As the only holder of your private keys you have full control over your crypto assets.

Recovery of assets

- Custodial: Recovery of assets is fairly easy and straightforward as the service provider has access to all your funds after verifying your identity.

- Self-custodial: Without your private key or recovery phrases recovery is impossible.

Security

- Custodial: There is always a risk of hacks by third parties and misuse by the provider.

- Self-custodial: Danger from hacks is significantly reduced.

Creating accounts

- Custodial: Lengthy know-your-customer and anti-money laundering procedures make it difficult to create and use accounts and expose them to the arbitrariness of legislators and providers.

- Self-custodial: No KYC and AML procedures.

User friendliness

- Custodial: Great user-friendliness with a variety of services offered.

- Self-custodial: Requires basic technical understanding. The options for using various crypto services are also reduced.

What Things Can You Do With a Self-Custody Wallet?

Self-custodial wallets usually offer the following functionalities:

- Storage of cryptocurrencies and other cryptoassets such as NFTs.

- Buying and selling cryptocurrencies — this usually includes the most popular currencies, tokens, and stablecoins.

- Swapping — i.e. the simple exchange of one currency into another.

- Transfer of crypto assets.

- Some wallets also offer payment services for purchases from merchants that accept crypto.

How to Find the Best Self-Custody Wallet

When it comes to crypto wallets, the most important aspect is security. The following points are essential when picking a self-custody crypto wallet.

When was the wallet launched?

As a rule of thumb, you want to stick with wallets that have a long history. because important information (e.g. hacking reports) can be found more easily. With a new crypto wallet, possible weaknesses and risks are often not yet known.

What does the wallet provider do to ensure security?

Different providers use different ways to make sure that their products are secure. Usually, you can find relevant information on their website:

- Is the wallet’s code open-sourced? This is a very good way to ensure security because the code can be checked by external developers.

- Security compliance & certificate? Does the provider give any information on the security compliance system they have implemented? If their code is not open-sourced, has a third-party security company audited the code? Have they obtained any security certification? Etc.

- What do the users say? Check the relevant Subreddits and third-party review pages such as Trustpilot on what people think about the wallet.

Can you trust the team or company that built the wallet?

Answer the following questions:

- Who is the team or company behind the wallet?

- Do they have relevant knowledge and experience in this field?

- Does the company have a solid background?

What is the profit model for free self-custody wallets?

If the wallet you are using is free, then it is worth finding out what the profit model is. Knowing the profit model helps you to understand how the company motivates its developers and engineers to build a state-of-the-art product.

For example, some free wallets take commissions when users swap coins or buy crypto using their integrated third-party partners.

What features does the wallet offer?

- What assets are supported? This includes coins, tokens, NFTs, etc. different wallets supports different number and kinds of crypto assets.

- Is there a built-in decentralized exchange (DEX) in the wallet? This makes it easier to change tokens and coins without having to transfer them to a centralized exchange.

- Is there integration with Web3? If so, that means the users can access DeFi protocols from the wallet, and functions such as staking, lending, and borrowing can be done from the wallet easily.

- Is there integration with fiat? This means the user can use their credit or debit cards to buy crypto directly and get the crypto sent to the wallet. Very convenient. However, it is worth paying attention to the fees for doing so. Because some free wallets profit from these fees, it could mean that you have to pay a higher fee for convenience than buying crypto from a centralized broker or exchange directly.

- Is there a connection with Lightening Network? This is especially important if you are a Bitcoin user.

- How user-friendly is it? Does the user interface neat and easy to follow? Are there detailed tutorials? Do they provide technical support?

Frequently Asked Questions About Self-Custody Wallets

Here is some more answer to commonly asked questions about self-custodial crypto wallets.

Are self-custody wallets safe?

In principle, self-custodial wallets are safe because you have full control over your keys. In practice, however, it depends on how careful you are with your keys.

Can self-custody wallets be hacked?

Yes, but it is much more difficult than with non-custodial wallets. Because the private keys are generated on your device and are not accessible to the manufacturer either.

All Comments