The growth of non-fungible tokens (NFTs) has been undeniable, but a decline in transaction volume has raised concerns about liquidity in the market.

Liquidity is a crucial aspect for the development of both Decentralized Finance (DeFi) and NFT ecosystems. The unique nature of NFT assets, however, exacerbates liquidity concerns. Even within the same series, NFTs can vary significantly due to their inherent uniqueness. This makes transactions heavily reliant on subjective factors. Most NFT art pieces lack a counterparty, resulting in valuable assets that are difficult to monetize. Unlike fungible tokens, non-fungible NFTs lack a unified pricing standard, complicating valuation and further impacting liquidity.

High floor prices for blue-chip NFTs also pose challenges for users. The floor prices for some top-tier NFTs can reach tens or even hundreds of Ether (ETH), making the market primarily accessible to large-scale investors or "whales," while average participants can only watch from the sidelines.

Several platforms have attempted to address liquidity issues by expanding NFT trading methods and scenarios. They have introduced solutions such as order books, automatic market makers (AMMs), NFT aggregators, and NFT derivatives. However, these efforts have proven insufficient in tackling the core issue of limited NFT liquidity. Litra Finance, an NFT liquidity protocol, believes that addressing the root cause of the liquidity problem requires a focus on the depth of NFT liquidity, in order to incentivize and enable liquidity providers to consistently supply liquidity to the market.

Litra Finance: Enhancing NFT Liquidity on the Ethereum Blockchain

Litra Finance is an NFT liquidity protocol built on the Ethereum blockchain, striving to provide deep liquidity for NFTs and revolutionize the NFT market. As part of the Web3 ecosystem infrastructure, Litra Finance has established an open and shared Web3.0 NFTFi+AMM platform, which optimizes NFT asset pricing mechanisms and enhances the accuracy of NFT transactions.

To ensure the security of its platform's smart contracts and protocols, and minimize the risk of exploitable vulnerabilities, Litra Finance has been audited by Supremacy, a reputable blockchain security audit firm.

Customized Bonding Curve and veToken Economic Model: A Solution for NFT Liquidity

What is NFT liquidity?

Liquidity refers to the balance between an asset's sale price and the speed at which it can be sold. In a liquid market, assets can be sold quickly at a relatively fair price, while in an illiquid market, assets often need to be discounted for a quick sale. Litra Finance seeks to improve NFT liquidity by increasing transaction speed—enabling faster matching of buyers and sellers—and enhancing the NFT market pricing mechanism, allowing users more control over the trading prices of NFTs.

How does Litra Finance achieve this goal?

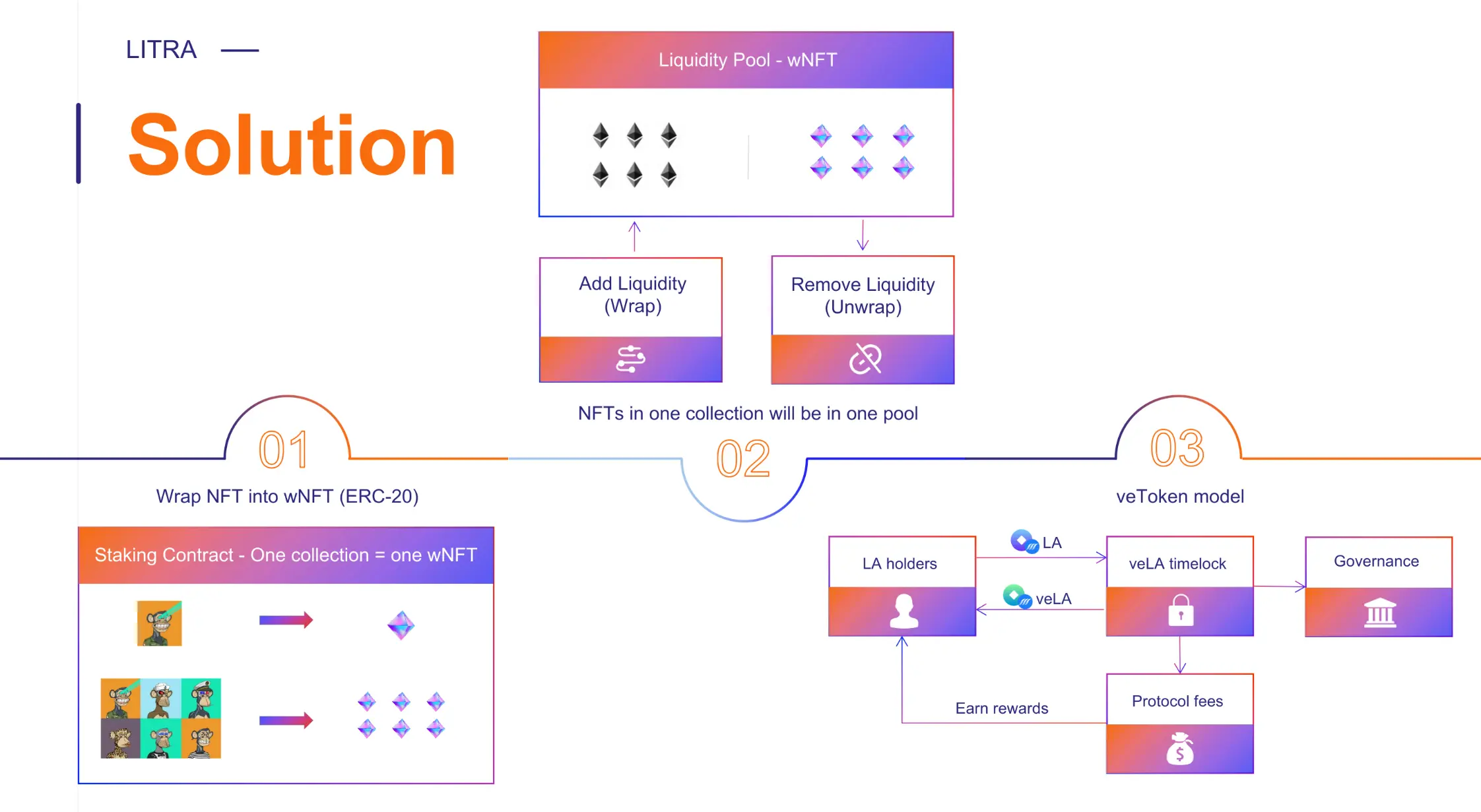

Litra Finance has developed a comprehensive set of liquidity protocols to address NFT liquidity challenges by leveraging customized transaction curves and veToken models. These protocols aim to create a more effective NFT market pricing mechanism. The following chart outlines how the Litra platform works:

A key innovation of the Litra Finance platform is the conversion of ERC-721 standard NFTs into ERC-20 tokens. Cash is the most liquid asset in any market because it can be instantly exchanged for goods and services at par value. Utilizing Litra's flexibilization feature, users can wrap and mint non-fungible NFT assets into divisible and fungible tokens, significantly enhancing NFT liquidity while reducing holding costs and risks. Furthermore, NFT tokenization paves the way for the development of DeFi ecosystems, including lending, mortgages, and derivatives.

Litra's liquidity pool is built on Curve, a popular automated market maker (AMM) running on Ethereum that combines the functionality of an automated centralized liquidity AMM with customized bonding curves. Sellers can convert their NFTs into fungible tokens and sell them in the AMM trading pool to complete transactions. Buyers can purchase promising NFTs in the AMM trading pool according to their capital scale, acquiring the corresponding share of the NFT. Customized bonding curves can adapt to different NFT trading scenarios, minimizing the discrepancy between the expected transaction price and the actual execution price, as well as reducing transaction slippage. This feature also mitigates impermanent loss for liquidity providers, allowing users to better hedge against fluctuations in asset prices within the liquidity pool.

To incentivize liquidity providers to actively and consistently contribute to the platform, Litra Finance has adopted the Curve v2 model and introduced the veToken economic model to increase the depth of the NFT trading pool. Additionally, users can convert their tradable tokens into locked veTokens to participate in Litra's decentralized autonomous organization (DAO). This model offers greater rewards for long-term token holders, such as platform profits and governance rights, aligning user interests with those of the platform and reducing selling pressure on platform tokens.

Participating in Litra Finance's NFT Liquidity Market

Interested in joining Litra Finance's NFT liquidity market? This guide explains how ordinary users can participate in the platform and benefit from its features:

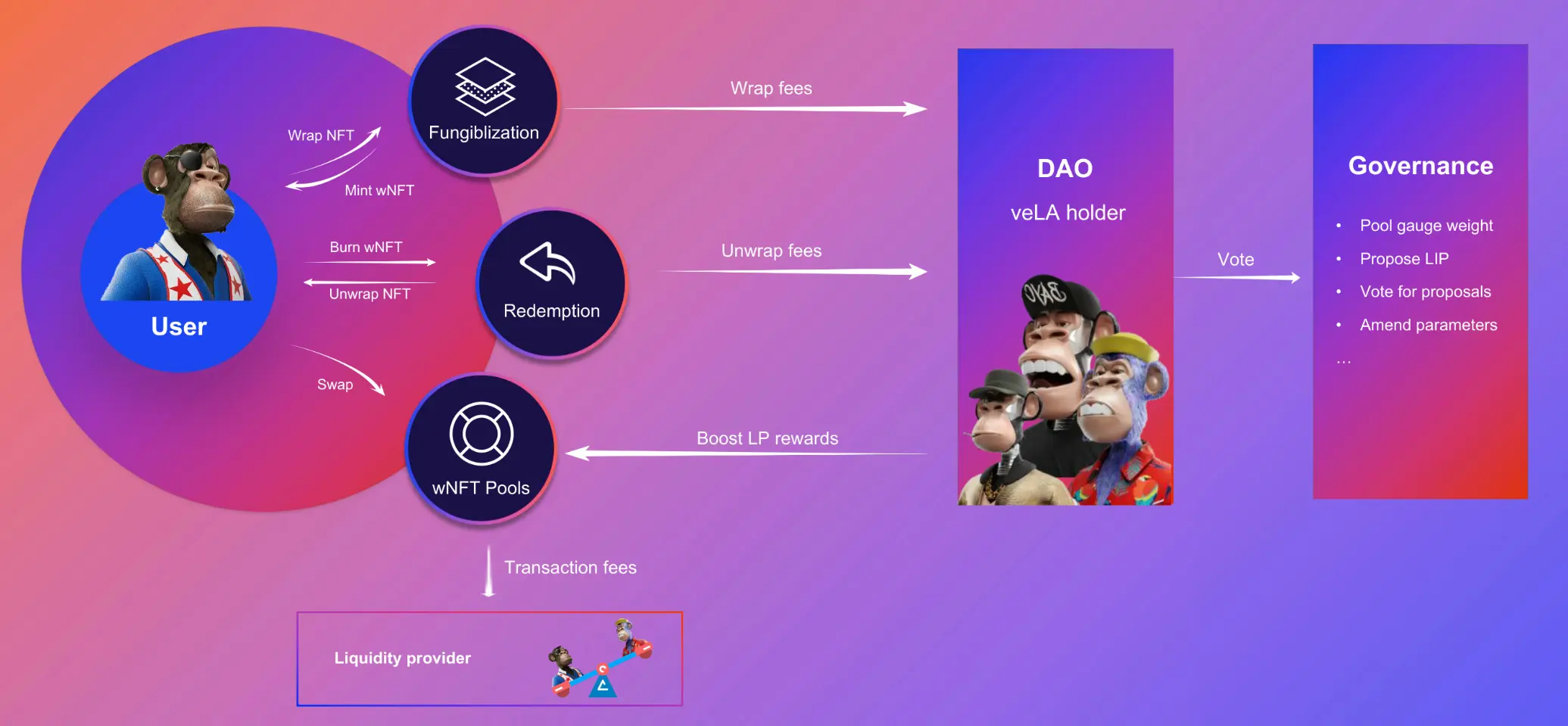

- Deposit your NFT on the Litra platform.

- Wrap and mint your NFT into wNFT tokens using the platform's fungiblization feature. Minting incurs a fee, which is allocated to the DAO.

- Redeem your NFT by destroying the corresponding wNFT tokens. Redemption requires payment of a handling fee, also directed to the DAO.

- Freely buy and sell wNFT tokens or become a liquidity provider by staking to earn liquidity mining rewards.

- Convert your tokens into locked veLA tokens to join the DAO community, participate in Litra platform governance, and share transaction fees. Increase liquidity mining rewards by voting.

Litra Finance is a platform that offers unique opportunities for NFT holders, traders, and enthusiasts, transforming the way they interact with the NFT market. By converting NFTs into WNFT tokens, Litra Finance allows users to trade freely in a liquidity pool, earn income from their NFT holdings, and participate in platform governance. There are five key roles within the Litra Finance platform: NFT holders, traders, redeemers, liquidity providers, and DAO members. Users can assume multiple roles simultaneously. Let's explore the benefits for each role:

- Benefits for NFT Holders

Litra Finance enables NFT holders to convert their NFTs into WNFT tokens and trade them within the platform's liquidity pool. This allows holders to perform NFT cashing and hedging, such as converting their NFT into WNFT when the NFT's price is high and buying WNFT to redeem their NFT when the price is low. This strategy helps NFT holders cash out and hedge against market volatility.

Moreover, Litra Finance turns NFTs from "zombie assets" into interest-bearing assets that generate income for their holders. By converting NFTs into WNFT and providing liquidity, users can earn transaction fees or obtain liquidity mining rewards. As a result, holding NFTs is no longer solely for collection purposes but also brings tangible benefits to holders.

- Advantages for NFT Traders

Litra Finance lowers the entry barrier and investment risk of the blue-chip NFT market, allowing traders to invest in NFTs at a lower cost and with reduced risk. Users who cannot afford high NFT prices can participate in the NFT market by purchasing WNFT shares, indirectly benefiting from the value growth of the NFT market. This approach enables more users to engage in NFT investment, making the entire market more active and diverse.

- Opportunities for NFT Redeemers

Users can "redeem" NFTs directly through WNFT to expand their NFT collection. Like traders, redeemers can also engage in NFT arbitrage to profit from market price fluctuations.

- Rewards for NFT Liquidity Providers

Liquidity providers bring stable liquidity to the entire market by offering NFT and WNFT liquidity, earning transaction fees and liquidity mining rewards in the process. By holding veToken, liquidity providers can also become DAO members, sharing platform fee income, increasing liquidity mining rewards, and gaining greater influence over the platform's development.

- Involvement for DAO Members

As DAO members of Litra Finance, users can participate in platform governance and play a crucial role in the platform's operation and development. DAO members can jointly share platform fee income, increase liquidity mining rewards, and participate in making important decisions about the platform's development.

Navigating Opportunities and Risks in the NFT Market with Litra Finance

Litra Finance offers innovative solutions for various participants in the NFT market by converting non-fungible NFT assets into interchangeable wNFT tokens. This process facilitates smoother asset transactions and leverages Automated Market Maker (AMM) with customized transaction curves to reduce slippage rates and impermanent losses. The platform also introduces the veToken model to encourage liquidity providers to contribute consistently.

Despite its promising features, Litra Finance faces potential risks and challenges as an emerging project. Although the platform has undergone audits, it remains susceptible to hacking or smart contract vulnerabilities, as is the case with any blockchain-based platform. As global governments tighten regulations on cryptocurrency and NFT markets, Litra Finance may encounter corresponding regulatory challenges, potentially impacting its operation and development. The NFT market is highly competitive, with numerous projects exploring and addressing liquidity issues from various perspectives. To attract a significant user base and secure funds, Litra Finance must continuously invest time and effort in refining its offerings.

Given the potential risks and uncertainties, it is crucial for users to carefully evaluate the associated risks and make informed decisions before investing or participating in Litra Finance. By understanding the platform's benefits and potential drawbacks, users can navigate the NFT market more confidently and effectively.

All Comments