Global non-fungible token sales volumes reached $2.82 billion in the first half of 2025, showing a small decrease of 4.61% from the $2.96 billion in sales recorded in the second half of 2024.

CryptoSlam data shows that despite the drop, the market surged in the first quarter of the year with $1.59 billion in sales, before cooling off in the second quarter with $1.24 billion. January was the strongest month, recording sales volumes of $679 million.

In June, CryptoSlam data showed that sales dropped to $388 million, reflecting a broader downward trajectory through the second quarter of 2025.

CryptoSlam’s sales volume data measures primary and secondary sales of NFTs between wallets across various blockchains. Primary sales are the first time an NFT is sold, usually minted and sold directly by the creator. Secondary sales refer to the resale of NFTs after their initial mint.

Transaction activity and average NFT sales values remained relatively stable in the first half of the year. CryptoSlam shows that the number of monthly transactions in H1 2025 ranged from four million to six million, while the average value of an NFT sale ranged from $80 to $100.

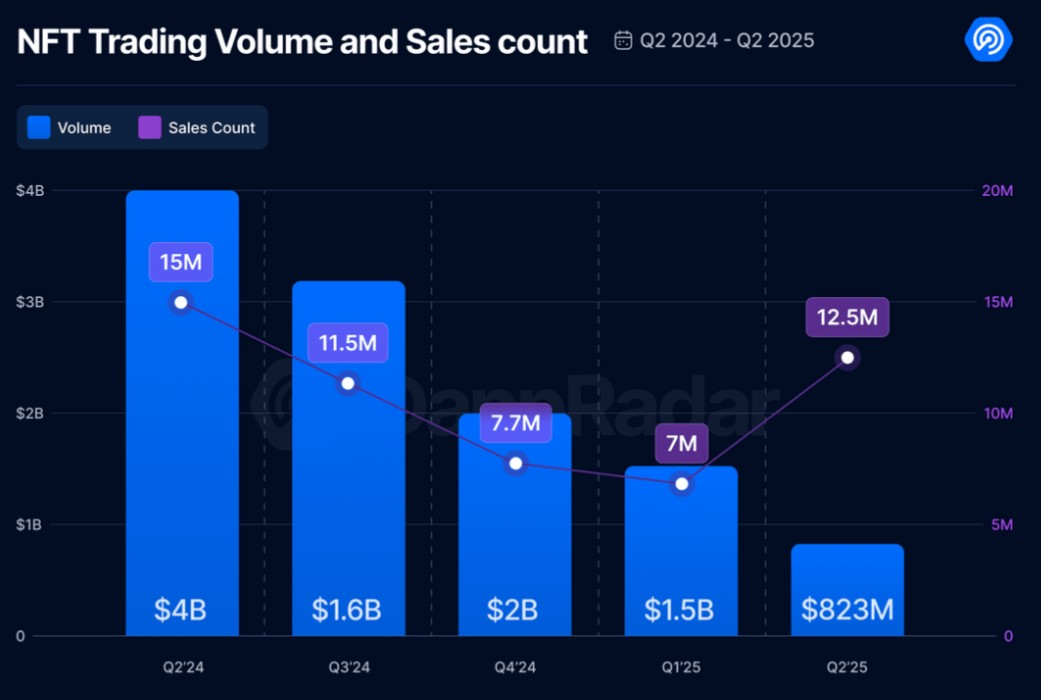

DappRadar data shows a consistent quarterly trading volume decline

According to a report from DappRadar, NFT trading volumes and sales counts decreased throughout 2024 — a trend that has continued in 2025. In the second quarter of the year, trading volumes reached $823 million, a 45% drop compared to the previous quarter’s $1.5 billion.

Despite the drop in trading volumes, NFT sales counts showed signs of life in the second quarter of 2025.

DappRadar’s trading volume data measures the total value of transactions across trading platforms or decentralized applications. Its sales count data refers to the number of individual NFT sales transactions.

While sales counts dropped in the last four quarters, Q2 2025 broke the trend, recording a 12.5 million NFT sales count despite lower trading volumes. This represents a 78% increase in sales counts compared to the previous quarter.

DappRadar said that this means that even though NFTs are becoming more affordable, interest in digital collectibles has not disappeared yet.

Lower volumes reflect a “healthier” market

However, Aubrey Terrazas, vice president of marketing at NFT platform Rarible, told Cointelegraph the lower volumes are a sign of a healthier, more sustainable market.

“We’re moving past pure speculation into real utility and community-driven projects,” Terrazas said. “Prices have normalized, but interest and innovation remain strong.”

Terrazas added that higher sales counts and lower dollar volumes reflect growing accessibility and affordability, fueled by multichain growth and the rise of new ecosystems.

According to Terrazas, this is a sign that the market is moving past its previous hype cycles into a more mature phase.

“Demand for digital assets is still strong, and we’re seeing NFTs power real go-to-market strategies for partners to build loyal communities and unlock new revenue streams.”

Snoop Dogg’s Telegram NFTs sell out in 30 minutes

Interest in NFTs may be cooling in some areas, but standout launches continue to generate buzz. American rapper Snoop Dogg sold out almost a million NFTs on Telegram in 30 minutes on Wednesday, signaling that interest in the space remains.

The new digital gift collection of 996,000 NFTs on the TON blockchain generated $12 million in sales, according to Telegram founder Pavel Durov.

TON’s NFT lead, who goes by the username Zenith on X, said Snoop Dogg’s NFT success in Telegram could spark a “new NFT narrative.”

All Comments